LEWISTON — As the incandescent light bulb began to fade out of our lives in the early 2000s, the future for Philips Elmet was not so bright.

Parent company Philips would phase out production of the tungsten filament bulbs in favor of more efficient LED bulbs, as consumers began to make the switch. That, in turn, reduced the importance of the Lisbon Street manufacturing plant to the Netherlands-based conglomerate. After 60 years of owning the facility, Philips Lighting wanted out.

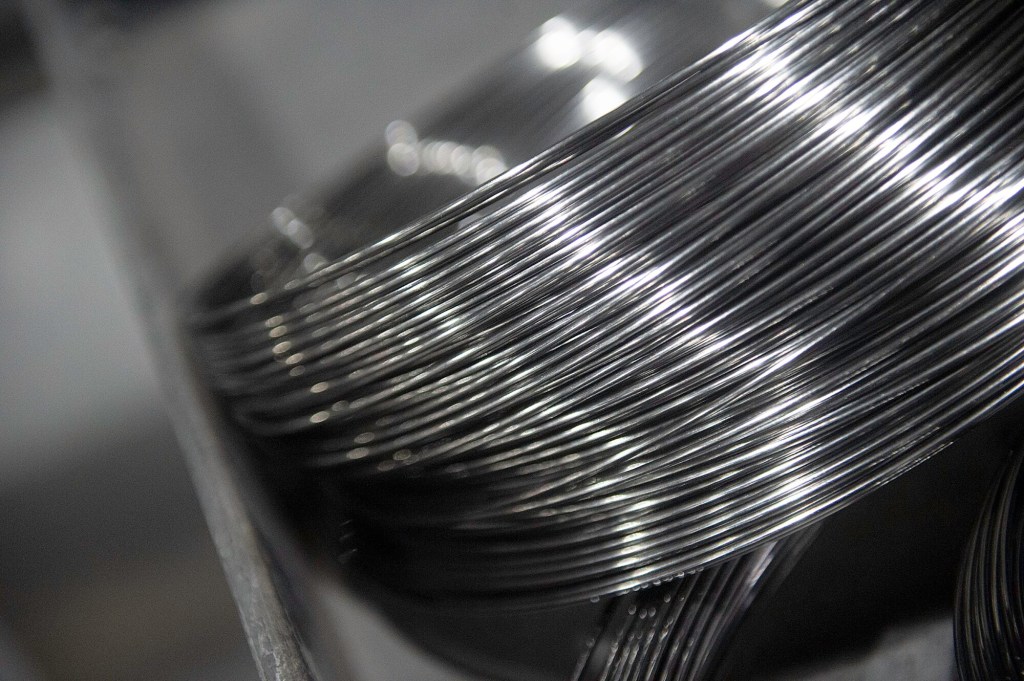

Known as Philips Elmet for decades, the Lisbon Street manufacturer at one point was the No. 1 supplier of tungsten light bulb filaments in the world. Sun Journal photo

Fortunately for the employees and the plant, the company always made nonlighting products. “We were able to survive as a stand-alone company without making light bulb filaments,” said Marc Lamare, vice president of sales and marketing for Elmet Technologies. “So, in the early to mid-2000s Philips allowed the company to be bought out by the management team at the time, with one significant majority investor: Jack Jensen.”

Jensen was Philips’ vice president of sales and marketing for the lighting division and was from Maine. At the time, he was quoted as saying the company’s lobby was “old, run-down and tired,” and reflected the company’s old-fashion industry. So he gave the lobby and the company’s image a makeover, with a focus on innovation and technological growth.

BACK TO BASICS

Lamare, who has been at Elmet for 39 years, said it was time to get back to basics. For Elmet, the basics are two metals on the periodic table of chemical elements: tungsten (atomic number 74, symbol W) and molybdenum (atomic number 42, symbol MO). They are the two core elements around which the company bases the majority of its products.

Tungsten is the strongest metal in the world with the highest tensile strength. It’s very dense and has the highest melting point of any metal. Molybdenum has similar properties, but to a lesser degree. Elmet Technologies knows tungsten and molybdenum very well and is the only fully integrated, U.S.-owned manufacturing facility of tungsten and molybdenum flat and round mill products.

Leo Wainwright, a heavy wire specialist, makes tungsten wire last week at Elmet Technologies in Lewiston. Daryn Slover/Sun Journal

That puts them at a huge advantage, because there are very few other sources of pure tungsten and molybdenum in this country, especially U.S.-owned and operated, and the applications for the metals are huge and growing rapidly.

Elmet has the experience and machinery to take tungsten and molybdenum powder, which is semi-refined, and process it into wire, plate, sheet and foil, cubes and spheres. It does so by pressure rolling it and heat treating it. The company is also making alloys from the metals, as customer demand and the applications grow.

Lamare said that historically, the biggest market for these products was for use in high-temperature furnaces and still is today. As one door closes, another opens.

As the demand for tungsten filament for light bulbs disappeared, semiconductors largely supplanted vacuum tubes, although the tubes are still manufactured and used in certain applications. Semiconductors are fabricated using tungsten and molybdenum, and with no fewer than six companies building nine new chip plants in the U.S., you can expect there will be high demand for the materials.

Silia Ndunga of Auburn works with tungsten wire last week at Elmet Technologies in Lewiston. The wire Ndunga is working with is 1/1,000th of an inch thick. Daryn Slover/Sun Journal

Intel is building four plants in the U.S., Micron is building a massive plant in New York, Samsung is building a plant in Texas, Taiwan Semiconductor Manufacturing Co. is building a plant in Arizona, GlobalFoundries is planning to build a plant in upstate New York and Texas Instruments has broken ground on a plant in Texas.

Tungsten and molybdenum also have applications in the medical field. Their density makes them good at blocking X-rays, so they’re used in imaging machines and radiation oncology equipment. And their high tensile strength — meaning they don’t stretch easily — make them sought after for the growing application of surgical robotics being pursued by major companies including Stryker, Medtronic, Intuitive Surgical and Johnson & Johnson.

OWNERSHIP CHANGES LEAD TO TURBULENT TIMES

Elmet Technologies saw two more ownership upheavals, one in 2006 when a sale to a Boston company fell apart, and another in 2008, when private equity firm Liberty Lane Partners took over. Liberty Lane Partners invested heavily on a potential switch by Apple to a new type of phone screen called sapphire glass, which is manufactured in high-temperature furnaces made from tungsten and molybdenum. But when Apple pulled the plug on the project at the last minute, Elmet was left with millions of dollars worth of tungsten and molybdenum bought in anticipation of the switch.

Essentially, Liberty Lane Partners turned control of Elmet over to the banks, whose goal was to get as much money back as they could. They marketed it, but the only potential takers wanted to sell off the assets and close the doors.

“That was a time when the company was very likely to fail and disappear,” Elmet Chief Financial Officer Derek Fox said. The bank was on the verge of liquidating and the management team was nervous.

“Employees didn’t even know what was truly going on behind closed doors,” Lamare said. “We were fearful that we would show up and find the doors locked by the banks.”

Lamare said the management team at the time knew the company had more potential as an ongoing entity and didn’t want the roughly 150 employees to lose their jobs. They found Peter Anania, the president and chairman of the Portland firm Anania & Associates Investments Co. Talks started in December 2014 and by Jan. 23, 2015, Anania & Associates was the new majority shareholder and remains so today.

Principals at Elmet Technologies in Lewiston are, from left, Chief Financial Officer Derek Fox, Anania & Associates owner Peter Anania and Vice President of Sales and Marketing Marc Lamare.

In 2020, Anania & Associates acquired another Lewiston-based manufacturer, Poly Labs.

The lead investor, Peter Anania, likes to say “we don’t flip companies.” Instead, he said, they love to help a company grow, build value and add Maine jobs.

In the ensuing seven years, Elmet Technologies has done well, according to Lamare. “We’re profitable, we’re growing like crazy.”

Elmet Technologies has 170 employees at its lone production facility in Lewiston and wants to grow to 225. The company has 25 open positions and it is willing to train people for them. Starting pay is above $20 an hour with a full package of benefits and no college degree required.

Like virtually all businesses today, hiring enough people remains a dilemma. The chief financial officer is worried they may have to turn away millions of dollars in business if they cannot hire enough people. One customer actually offered to send workers from one of its facilities to help get the work done.

Elmet’s human resources manager said applicants just have to want to work hard, not physical hard, just work hard. Some basic math skills will also be useful.

With adequate staffing, the company’s future looks bright.

“A lot of what we were able to do was by building on existing customers and expand the offerings they have,” Lamare said, noting Elmet’s online presence brings in dozens of inquiries from around the world every day.

The company supplies machined products and materials to the military and defense industries and, combined with aerospace, is the fastest growing market for the manufacturer. When a company in Alabama selling tungsten shut down a few years back, Boeing had to find another source and came knocking at Elmet’s door. The aerospace giant remains a customer.

Adam Kobel of Auburn works with a molybdenum plate last week at Elmet Technologies in Lewiston. Daryn Slover/Sun Journal

Lamare said the development of alloys has expanded their offerings and opportunities, because they are less expensive and easier to work with than the pure form.

In 2019, U.S. Sen. Susan Collins, R-Maine, helped Elmet Technologies secure a $4.2 million Department of Defense contract to develop tungsten heavy alloy and molybdenum products for the military.

Elmet is also making components for diodes and is building a dedicated proprietary production line for an original equipment manufacturer medical device maker. How they are doing it is secret, and they are held to strict specifications. There are other new applications that are also hush-hush — things management said they can’t discuss right now.

Speaking of secrets, Elmet officials said they are in the midst of working through and supporting the “next level” of development for alternative energy, but won’t say what or with whom.

“The people in this company have always focused on the customer and supplying quality products, working hard, leveraging technology,” Lamare said. “I believe that’s been the lifeblood of this company for a long, long time, even before I started . . . and I really think that’s what’s helped us stay here and be successful.”

Send questions/comments to the editors.